- Solutions

- Accounting

- Additional Documentation Requests (ADRs) Management & Support

- Clinical Consulting

- EHR Implementation & Optimization

- Medicaid Eligibility

- Outsourced Contract Controller Services

- Outsourced Revenue Cycle Management

- PointClickCare® Consulting

- QAPI Consulting

- Resident Trust Fund Management & Advisory Services

- Revenue Cycle and Reimbursement Consulting

- Who We Serve

- Resources

- Careers

- About Us

- Contact

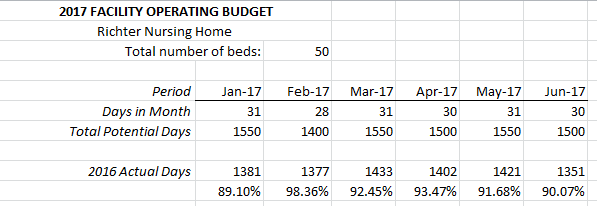

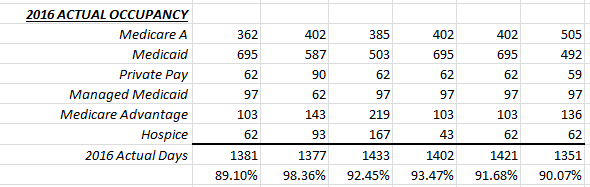

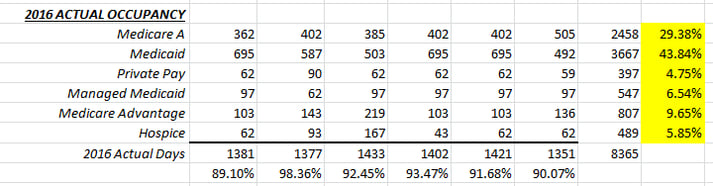

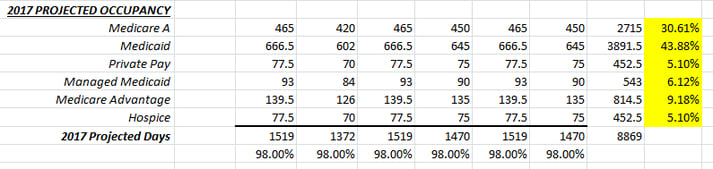

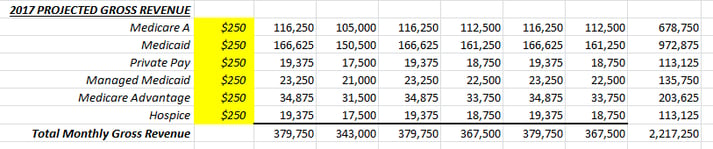

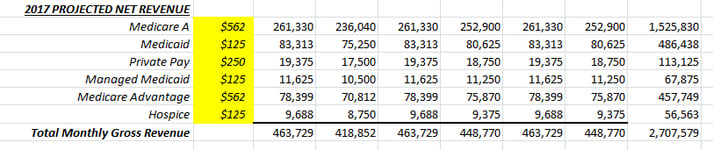

It’s that time of year again! If your Fiscal Year ends on December 31, you’ve probably been asked to start compiling your data in preparation for your 2017 operating budget. There is no doubt that the budget process can be grueling, but with a good strategy and some preparatory “leg work”, you can see the process through and produce some valid numbers that you can rely on for next year. The last thing that any manager wants to see is a budget that is not based on given, reliable history.

It’s that time of year again! If your Fiscal Year ends on December 31, you’ve probably been asked to start compiling your data in preparation for your 2017 operating budget. There is no doubt that the budget process can be grueling, but with a good strategy and some preparatory “leg work”, you can see the process through and produce some valid numbers that you can rely on for next year. The last thing that any manager wants to see is a budget that is not based on given, reliable history.